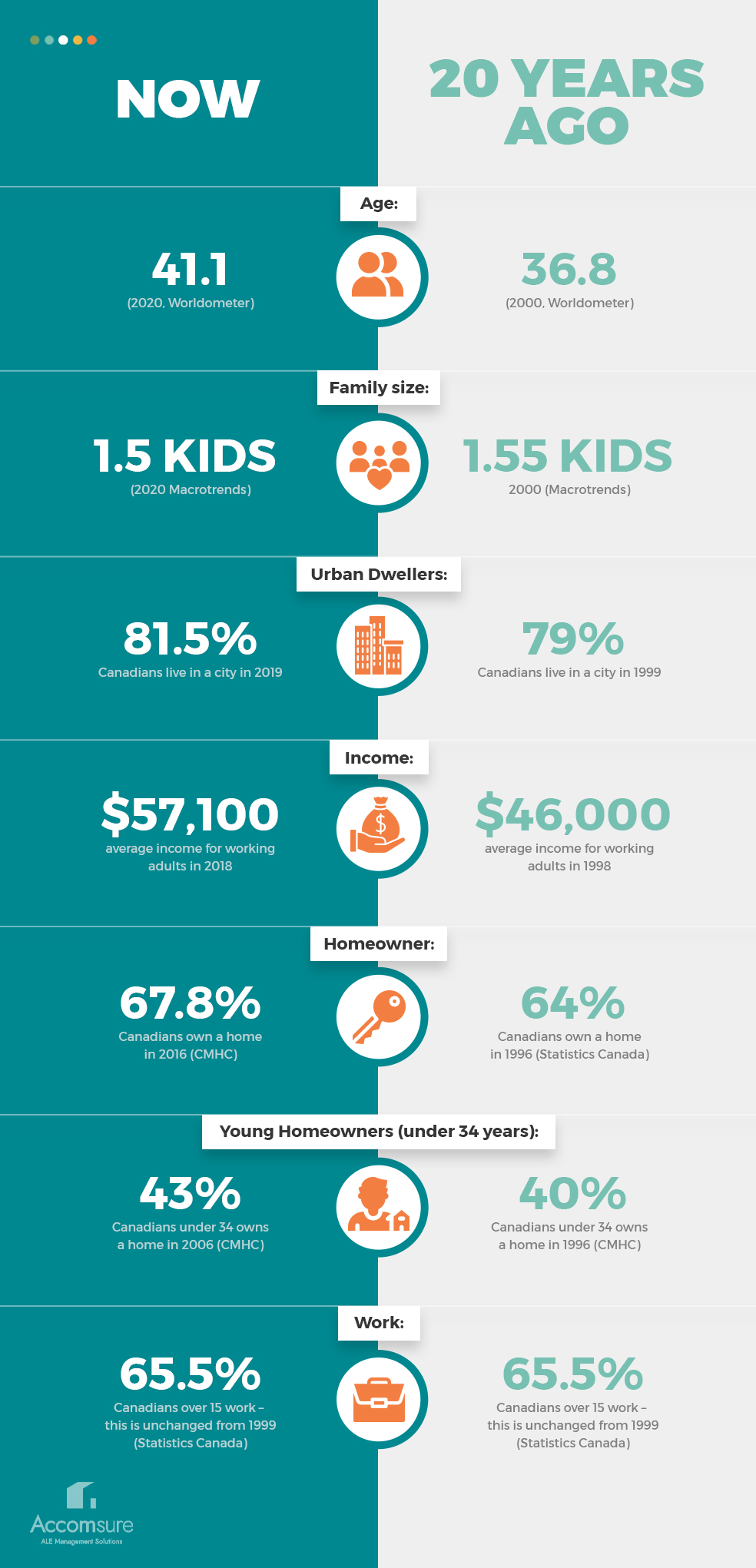

In this month’s blog post, we’re having a look at us, Canadians. As a people, how much have we changed in the last 20 years?

Who we are and how we live has a big impact on many different industries, including home insurance.

We’ve gathered some key stats on Canadians and Canadian families to compare how we live and work now and 20 years ago and wrapped them up in an infographic for you.

We’ll also take a deep-dive into some of the most interesting shifts and how they might impact the home insurance industry.

Facts About the Typical Canadian

An Aging Population

One of the most significant shifts in this millennium is the growing population of senior Canadians.

One of the primary drivers of the population shift is that we live longer. From 1998 to 2018, our life expectancy has grown from 78.6 to 81.9 (The World Bank) and the typical Canadian is now 41 years old, compared to 37 years old in 2000.

While the Canadian population is aging, our seniors are still overwhelmingly living independently in their own homes. In 2006, only 1 in 3 Canadians over 85 years old lived in a communal setting such as a nursing home or seniors lodge – although this proportion is rising (Statistics Canada). A Statistics Canada survey showed that only 20% of seniors were considering downsizing or moving to a communal living setting. This data points to a trend where Canadian seniors choose to remain in their homes, which are aging with them.

Responding to the Needs of Seniors

When our seniors chose to age in place–remain living independently in their own home– insurance companies will have to respond to the shifting demand.

While the age of the home typically has a bigger impact on home insurance rates than the age of the homeowner, seniors, in general, have different needs and risk factors compared to younger policyholders. Senior policyholders might have a lower capacity to maintain and prevent damage around their (aging) home. In addition, if the policyholder is displaced due to home damage, finding a temporary home that meets their needs, e.g. when it comes to accessibility/mobility can be a challenge.

Senior policyholders will also have different customer service expectations than their younger counterparts. While many home insurance companies are moving towards an increasingly digital service model, their eldest customers might not be prepared to jump on the digital bandwagon.

Urbanization

While urbanization is not a new phenomenon, it shows no sign of slowing down.

In 2019, more than 4 out of 5 Canadians lived in a city. 100 years earlier, only around 50% of Canadians were urban dwellers (Statistics Canada).

For the home insurance industry, the increased density of policyholder into specific geographic areas have a mixed impact.

The Effect of Urbanization on Home Insurers

On one hand, with an increasing number of extreme weather events, it makes it easier for federal and local governments to protect and develop mitigation plans for cities with a highly concentrated population.

On the other hand, when disaster strikes, it hits both the city and insurance companies devastatingly hard. Rehousing policyholders following large-scale, urban disasters remains a major risk for insurance providers, and responding to this type of catastrophic event will only become more complex in the years to come.

Another factor associated with urbanization is the value of homes. With an increasing demand for housing in cities, the property values will be driven up, in turn increasing the value of home insurance claims. Although the growth of Canadian housing prices has slowed down in the last year, strong immigration, urbanization, and a reduction in new builds are expected to drive home prices back up again (Global Property Guide).

Responding to the Shifting Needs of Policyholders

Adjusting to the needs of a shifting demographic can be a real challenge for home insurers.

Keeping costs in check while proving excellent customer service will be critical for the industry in the years to come. Professional ALE management is one way for home insurance providers to boost customer service for their senior policyholders and can help offset the rising cost of urban home insurance claims.

Accomsure provides expert management of all aspects of ALE and smart claims management. We have vast experience providing a seamless, pain-free, and cost-effective transition into temporary housing. Contact us today to learn more about our services, and how we can help you better manage ALE requirements of home insurance claims.