How can insurance companies better meet customer expectations?

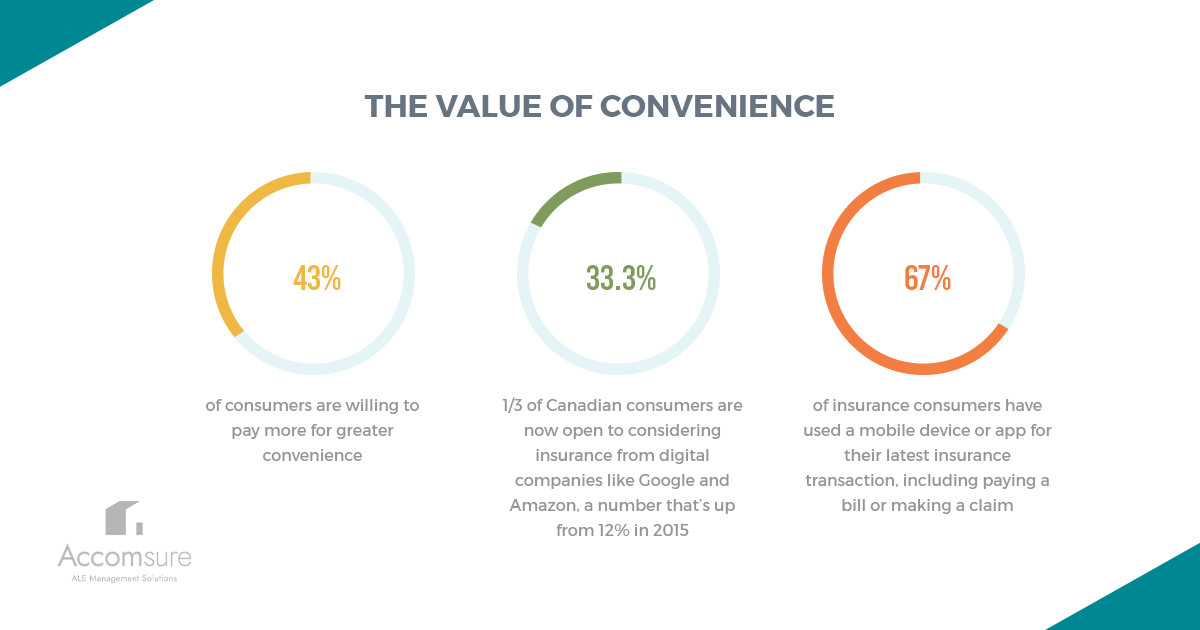

With higher customer expectations around fast, convenient services, for home insurance providers, the looming threat of disrupting forces is very real. A third of Canadian consumers are now open to considering insurance from digital companies like Google and Amazon, a number that’s up from 12% in 2015 (J.D. Power).

Although digital strides have been made, many insurance companies still need to catch up with other industries. Younger consumers are keen to engage with companies from their phones, for example via social media and mobile-optimized websites. At the same time, policyholders across all generations are jumping on opportunities to manage their insurance more conveniently. In fact, 67% of insurance consumers have used a mobile device or app for their latest insurance transaction, including paying a bill or making a claim (J.D. Power).

For home insurance companies, many are at a turning point. Either they find ways to boost the customer experience or risk missing out on many of the opportunities to make their policyholders happy and boost their bottom line.

The Critical Role of Customer Satisfaction

Insurance companies operate in a highly-regulated, highly competitive market where it’s difficult to differentiate policies without lowering prices. Because of new, online tools such as online policy comparison websites, it’s never been easier for consumers to directly compare policies and prices. With those two factors in mind, how can insurance companies set themselves apart from their competition?

Price is of course still a major deciding factor for home insurance customers, but for a number of reasons that we covered in a previous blog post, reducing insurance rates is often off the table. Instead, providing great customer service is one of the only ways that insurance companies can gain a competitive edge.

Using car insurance as an example, a 2016 McKinsey report shows that insurers that have provided consistently great customer service gain a number of advantages, compared to insurance companies with inconsistent customer service performance.

Since there’s no reason to believe that auto insurance customers are widely different from home insurance policyholders, this data should be a compelling argument for a laser-focus on customer service and satisfaction.

High Service Expectations

Consumer expectations have changed dramatically when it comes to the level of customer service they receive from a company. With new generations of digital natives on the market for home insurance, insurers are faced with a balancing act between wooing new, tech-savvy consumers who have high expectations around fast, convenient services while retaining their existing customer base.

In many other industries, digital technology has completely up-ended the customer experience, from researching companies to buying and getting customer service support. One-click shopping, 24-hour, instant customer support, quick and free delivery, clear and transparent pricing. Existing and potential policyholders bring their experiences and expectations of fast, convenient service from other sectors to the table when they evaluate their home insurance providers.

One way of looking at this development is to conclude that policyholders are becoming more demanding. On the other hand, from a customer perspective, it seems reasonable to look for an insurance provider that makes life easier for them.

Although many insurance providers have started offering apps and other digital tools, it’s not all about the technology. It’s really about finding opportunities to provide a consistently high level of customer service and communication across product lines and customer service channels. Without this true, deep-rooted commitment to customer service, developing an app without the underlying service framework is like putting lipstick on a pig.

To rise to the challenge, insurance providers have to take a hard look at whether their processes are geared to meet customer expectations.

Streamlining Customer Service

Fast. Convenient. Personalized. These should be the gilding pillars for every system an insurance company puts in place.

Automation and Outsourcing

Systems that speed up policyholder communications and claims processing will be key for home insurance providers to increase customer satisfaction and retention now and in the years to come.

For some companies, streamlining processes means finding technological solutions that make claim handling easier and more automated. For other insurers, a better process would be outsourcing specialized services.

Although a complex claim will still require several manual touchpoints, handling the simpler home insurance claims more easily will allow adjusters to focus on those trickier, more work-intensive claims.

Communication

During the claims process, there are a number of ways adjusters can make use of communication tools to dazzle their policyholders.

First, you’ll need to know what platforms your policyholders use and like. There are so many new ways to interact with policyholders such as texting updates, live chat, or facetime, or even using social media messaging systems. Again, it’s not about the particular technology, but about convenience for the policyholder. If they’re texting all the time but never check their email, why not meet them where they’re at?

A better, more convenient experience does not only translate into improved customer retention, it potentially offers a more valuable product. A survey from PWC shows that 43% of consumers are willing to pay more for greater convenience.

Lower Cost of Claims

Not only can better systems, outsourcing services, and automation boost customer satisfaction, it can also drive down the cost of handling claims by as much as 30% (McKinsey).

With an improved, more automated process for handling claims, adjusters can also focus their time more strategically. Rather than being inundated by a large volume of claims ranging from simple to complex, handling simple claims can be taken out via automated processes and specialized service providers. That means adjusters can focus their attention on resolving more complex claims successfully and prevent costly disputes and other problems along the way.

Gearing Up For the Home Insurance of Tomorrow

Meeting high customer service expectations is poised to be a game-changer for the home insurance industry in the years to come.

Providing excellent customer experience and satisfaction has never been as important as now. Demonstrating value while finding cost-saving measures are equally critical for insurers.

For many home insurance providers, professional management of ALE is an additional measure for boosting policyholder satisfaction and cutting claims costs. Accomsure provides expert management of all aspects of ALE and smart claims management. We have vast experience providing a seamless, pain-free, and cost-effective transition into temporary housing.

With policyholders looking for speed and great communication, those are areas where Accomsure excels. Contact us today to learn more about our services, and how we can help you better manage ALE requirements of home insurance claims.