In May 2016, a large wildfire devastated the city of Fort McMurray and the surrounding area. The unpredictable and destructive wildfire became the most expensive, insured natural disaster in Canadian history and had tremendous impacts on the residents affected and the insurance industry as a whole.

In this blog post, now 4 years after the wildfire, we’ll have a look back at how the wildfire unfolded and the insurance industry impact of the disaster.

The 2016 Fort McMurray Wildfire

After unusually hot and dry spring weather, on May 1, 2016, a wildfire was discovered in a forested area 7 km outside the city of Fort McMurray in northern Alberta. Initially, the wildfire only spanned 2 hectares. However, despite immediate efforts to control the fire, on the evening of May 1, residents on the south end of Fort McMurray were alerted to shelter-in-place and prepare for evacuation.

On May 3, the rapidly-growing fire was propelled by high temperatures, low humidity, and wind. It jumped the rivers surrounding the city and triggered mandatory evacuation notices for the entire city. In the early afternoon, homes started catching on fire. The citizens of Fort McMurray were stuck in bumper-to-bumper traffic with fires blazing on both sides of the only road out of town, as they scrambled to flee the city to the north and south.

Four days in, the Province of Alberta declares a provincial state of emergency and mandatory evacuation orders are issued to the communities surrounding Fort McMurray. In the days to come, oil production is halted in various facilities north of the city and employees from oil and gas companies are evacuated from the area.

On June 1, the province started allowing Fort McMurray residents to re-enter parts of the city. Meanwhile, firefighters continued the battle against the raging wildfire that at its peak was estimated to span close to 590,000 hectares, including parts of Saskatchewan. The wildfire was officially declared out on August 2, 2017.

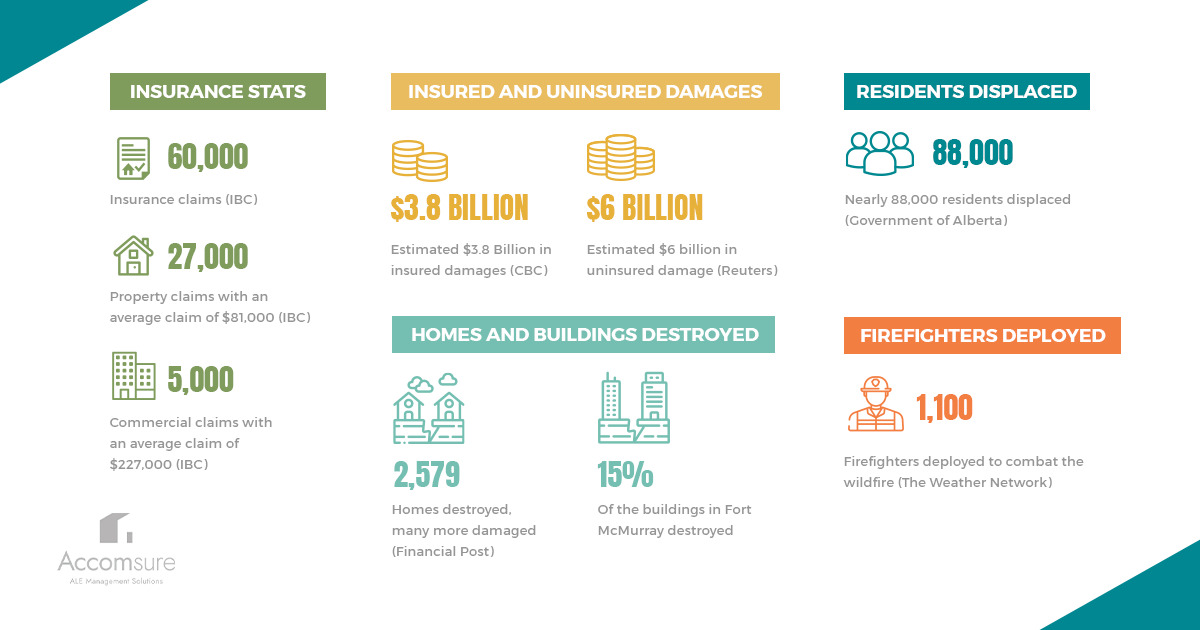

The wildfire ended up destroying 15% of the buildings in Fort McMurray and set a sad record as the most expensive natural disaster in Canadian history. The damage from the wildfire was more than double as costly as the previous record, the southern Alberta flood of 2013.

Fort McMurray Wildfire by the Numbers

- 60,000 insurance claims (IBC)

- Estimated $3.8 billion in insured damages (CBC)

- Estimated $6 billion in uninsured damage (Reuters)

- 2,579 homes destroyed, many more damaged (Financial Post)

- 27,000 property claims with an average claim of $81,000 (IBC)

- 5,000 commercial claims with an average claim of $227,000 (IBC)

- Nearly 88,000 residents displaced (Government of Alberta)

- $125 million donated to Red Cross relief efforts (YMM)

- 1,100 firefighters deployed to combat the wildfire (The Weather Network)

Insurance Industry Impact

A massive, record-breaking disaster such as the Fort McMurray wildfire sends shockwaves through both the impacted community and home insurance providers responding to the fire.

The aftermath of the wildfire highlighted the challenge of responding to large-scale natural disasters such as the wildfire in Fort McMurray and similar, future events.

Addressing Climate Change

For the insurance business, the record damage from the Fort McMurray fire was yet another wake-up call to the looming risk of climate change. Just within Alberta, the record for the costliest insured disaster in Canadian history had been broken twice in 3 years. The uptick in damage caused by natural disasters and extreme weather events is not just a local phenomenon. Insurance Bureau of Canada (IBC) data shows that the global economic cost of natural disasters has risen by 500% since the 1980s.

As a response to the increased frequency and scope of natural disasters, IBC called on governments on all levels to create more expansive climate policies and take steps to make communities around the country more resilient to floods, fires, and other extreme weather events.

Crisis Insurance Claim Management

In the wake of the wildfire disaster, the damage to homes and businesses highlighted the enormous complexity and challenge of responding to such a massive volume of claims.

Delays in claims processing along with mistakes, poor service, and inconsistencies in claims handling sparked criticism from policyholders and the media in the years following the fire. Overall, the Fort McMurray disaster proved a stress-test to the insurance system and highlighted the cracks that can start to appear when handling such an unprecedented volume of claims.

Stress and an overwhelming workload for the insurance adjusters who responded to the wildfire proved a challenge. As Ted Koleff, vice president of claims for AMA Insurance, told Insurance Business Canada, “It’s certainly been a challenge from the perspective of being able to provide the level of service that we pride ourselves on.”

On the 3-year mark of the wildfire, 190 home insurance claims remained unsolved in Fort McMurray, which represented fewer than 1% of the total home insurance claims (Insurance Business Canada). The last claims were described as ‘complicated’ or were stalled by poor communication and disagreements between the policyholder and their insurance company, according to IBC.

Calls for Changes to the Insurance Act

Provincial legislation sets a 2-year limit for resolving insurance claims related to wildfires. Due to the extraordinary scope of the wildfire, insurers were struggling to resolve all claims within this window. This situation led to insurers voluntarily offering extensions for claims beyond the required 2-year period after the provincial government threatened to change the insurance act.

For many of the unresolved, complex claims, the primary pain point for policyholders was depleted ALE, which left them footing the bill for temporary housing along with the mortgage for their destroyed home while waiting for the insurance payout.

While no legislative changes happened following the Fort McMurray fire, for insurers it was a lesson on the risks large-scale disasters can present. The majority of the home insurance claims were resolved successfully, but a few complicated claims damaged the image of insurance providers and led to drawn-out conflicts and frustrated policyholders.

Disaster-Proofing Home Insurance

Given the rapidly increasing risk of wildfires, floods, and other extreme weather events in Canada, the Fort McMurray wildfire was another shock to the system for home insurance providers. Following the disaster, insurers started planning for how to better manage similar large-scale insurance events in the future.

With more wildfires and other large, natural disasters on the horizon for Canadian homeowners, ALE management is one way that insurance companies can curb claim costs and ease the workload for adjusters. Regardless of what disaster has caused a policyholder to look for a temporary home, Accomsure can help. By professionally managing all ALE aspects of a claim, Accomsure can support the adjuster with progressing the claim quicker, smoother, and at a lower cost for all parties.