Did you know Canada’s population has changed over the past 20 years? The average Canadian today is not the same person as they were 20 years ago, especially in regards to their age! One of the most significant demographic changes is the growing population of senior policyholders.

The “baby boomer” generation makes up a substantial portion of the population in Canada, which has contributed to the rising age of the average Canadian. Over the past 20 years, this large generation has aged into senior citizens, making the senior population particularly large.

In addition, Canadians are also lucky to live longer than ever before! This means that more people are fortunate enough to age into their golden years and experience the joys of longer lives.

However, with an aging population comes implications for many industries, particularly the home insurance industry. In this article, we’re covering important statistics regarding the aging Canadian population, their effects on the home insurance industry, and how the industry can adapt to provide better service to senior policyholders.

Canada’s Population is Going Grey

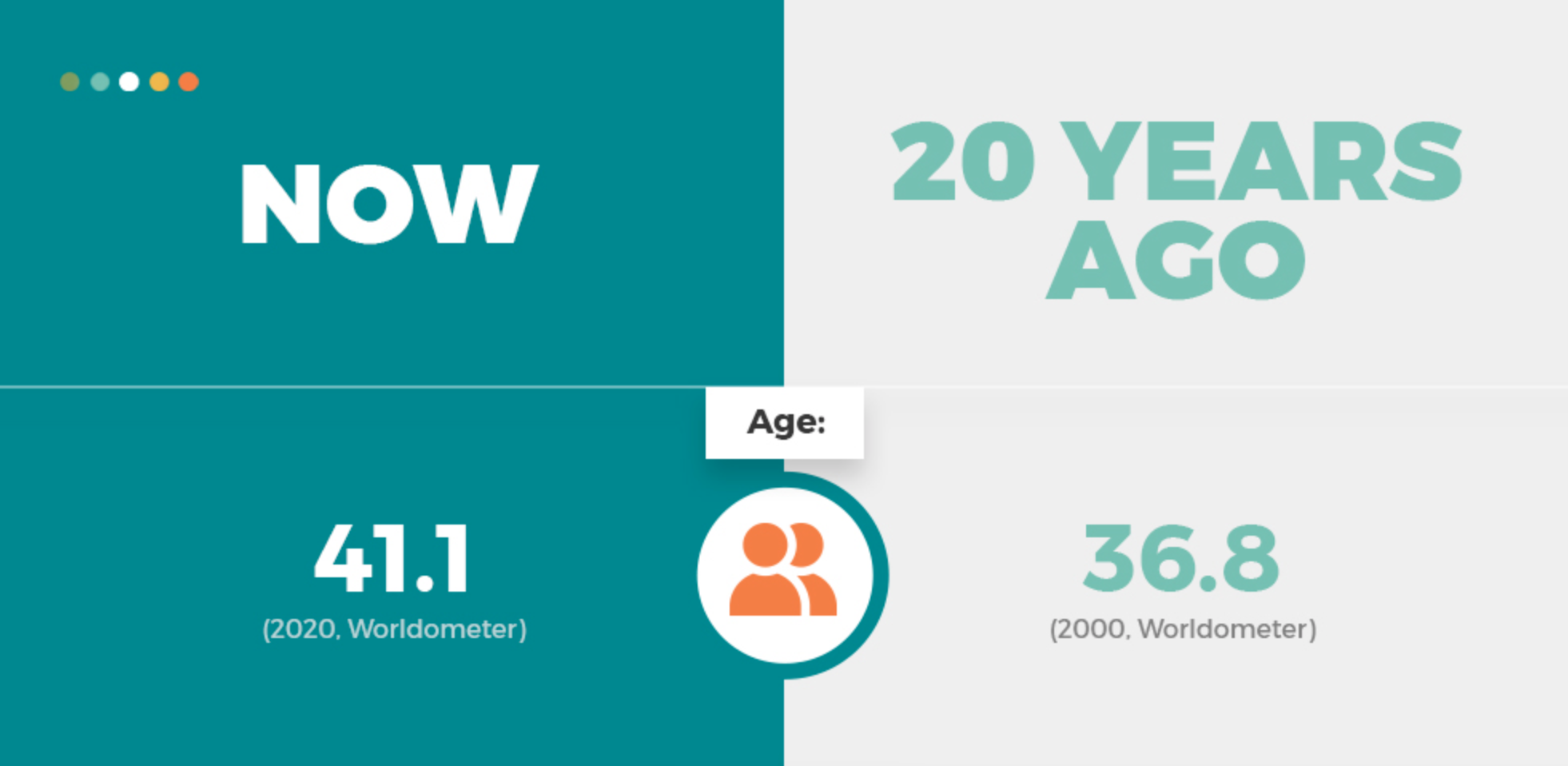

The data shows that Canada’s population is older now than it’s ever been before. According to Worldometer, the average Canadian is now about 41 years old compared to about 37 years old 20 years ago. As discussed above, there are a few reasons for this trend: (1) the first wave of “baby boomers” are nearing their mid-60s, and (2) Canadians are living longer.

In Canada, the “baby boomer” generation makes up 27% of the population and 16% of the population is currently 65 years or older (Randstad). Get ready for a grey tsunami! As the “baby boomers” grow older, senior citizens will make up a more significant percentage of the population.

In 2000, the life expectancy for Canadians was 79.14 years (The World Bank). Since then, Canadian life expectancy has notably increased to around 83 years. (Worldometer)

The trend towards an aging population is expected to continue in the coming years. By 2030, an estimated 20% of Canadians will be ages 65 or older (Canadian Underwriter), making up a significant segment of the population.

Along with the aging population comes an increasing number of elderly Canadians living in their own homes. For many seniors, aging in place is the dream. In 2016, only ⅓ of Canadians over 85 years lived in collective living arrangements (StatsCan). This means that a large proportion of the senior population is still living in their own homes.

Implications for the Home Insurance Industry

The large number of senior policyholders has a number of implications for the home insurance industry, which we will discuss in the sections below.

Higher Risk of Accidents

Although it’s important to note that every senior is different, seniors are more likely than other age demographics to experience several health issues that can lead to a higher risk of accidents in the home.

Many seniors in Canada experience varying degrees of hearing impairment, a diminished reaction time, and memory loss. This becomes a particular concern when it comes to responding to emergencies in the home. For example, hearing impairment could make it difficult to hear the sound of water rushing from a burst pipe and diminished reaction times could lead to difficulties efficiently responding to cooking fires. This could potentially increase their risk of significant property damage.

A Less Tech-Savvy Population

Compared to other demographics, seniors also tend to be less “tech-savvy” and may have a preference for more traditional claims processes. This is important to note in a time when many insurance companies are pushing for a digital transformation. People in the “baby boomer” generation are frequently less confident using technology and may be more hesitant to adopt fully digital claims processes.

Difficulties with Home Maintenance

When it comes to being a homeowner, consistent home maintenance is important to address issues before they become disasters. For example, inspecting the roof for leaks is crucial to avoid water damage and safety issues. However, these tasks become increasingly difficult and dangerous as people grow older.

Many seniors are fortunate to have family support or the ability to hire professional help. However, this isn’t the case for everyone. If policyholders are unable to maintain their homes or get the help they need, this could lead to an increase in property damage.

More Difficulty Re-Housing Elderly Policyholders

Compared to other demographics, seniors are more likely to experience disabilities and mobility impairment. While only 13% of youth aged 15-24 years old are affected by disabilities, 38% of seniors in Canada aged 65 and older have a disability (Statistics Canada).

Should a disaster strike in the home, people with disabilities have a more difficult time finding suitable temporary accommodation. Depending on the disability, policyholders may require housing with wheelchair accessible doors, ramps, bathroom grab bars, and other features that are not available in the majority of homes.

Recently, Accomsure helped place a family into temporary accommodation where one senior member had disabilities. We arranged for the addition of accessibility aids to the main level bathroom. This ensured that the policyholder could maintain their independence for the duration of their stay.

Providing Better Service for Senior Policyholders

As more of Canada’s population continues to age, it’s important for insurance companies to adapt in order to better meet their needs and respond to the shifting demand. Compared to younger policyholders, seniors have different needs and risk factors that are important for insurance companies and adjusters to address.

Below are a few ways you can provide better service for your senior policyholders.

Exercise Extra Patience

When assisting seniors with hearing impairment or memory loss, it is important to show extra patience. You may need to repeat yourself frequently and offer written explanatory documents to better help these policyholders through the claims process.

Involve Senior Policyholders in the Claims Process

Research suggests that seniors care about being in control of their own lives (Canadian Underwriter). That’s why it’s crucial that you involve your senior policyholders in the claims process. This includes everything from having a say in their contractor to having a say in their temporary residence. Ensure that you actively listen to what your policyholder wants rather than just telling them what to do.

Offer Alternatives to Digital Claims Processes

Although the shift to digital service models is exciting, it’s important to consider that senior policyholders may not welcome this new model with open arms. Digital insurance claims are generally associated with improved customer satisfaction, but senior policyholders tend to have different customer service expectations. By continuing to offer traditional service models as an option, you will ensure that your policyholders remain satisfied with your company.

For example, Accomsure recently made 56 phone calls to a senior policyholder over the course of their transition to temporary accommodation. This policyholder was only comfortable using the phone to communicate, they were very overwhelmed by the claims process, and had a number of questions. We were pleased to support this policyholder in the way they needed it most.

Submit Your Claims with Accomsure

As we discussed, re-housing seniors, particularly those with disabilities and mobility impairments, can be a challenge. That’s where Accomsure comes in to save the day.

At Accomsure, we can take care of your policyholder’s complex accommodation needs. This helps to keep accommodation costs in accordance with policies and is associated with increased customer satisfaction. We’ll use our extensive list of contacts to find accommodation that meets your policyholder’s needs and provide them with a pain-free transition into their temporary residence while you focus on the claim. Contact us or submit a claim today!